By Jacob Nakamura

The local magistrates reports are filled with embarrassing stories of people, who for whatever reason have stolen from others. The accusations of theft range from a young mother stealing food from a convenience shop to drug addicts taking other drug addicts's cars.

The police put themselves in harm's way and do the good detective work to make the arrests. The prosecutors pursue these charges in court. The government of Guam spends millions of dollars each year on the pursuit, capture, prosecution, and incarceration of thieves and car jackers.

If taking and keeping $10 from someone is called theft, what do you call it when you take and keep tens of millions of dollars that isn't yours to keep?

Apparently it's called a tax settlement, and everyone who should be doing anything about it in GovGuam is just okay with that.

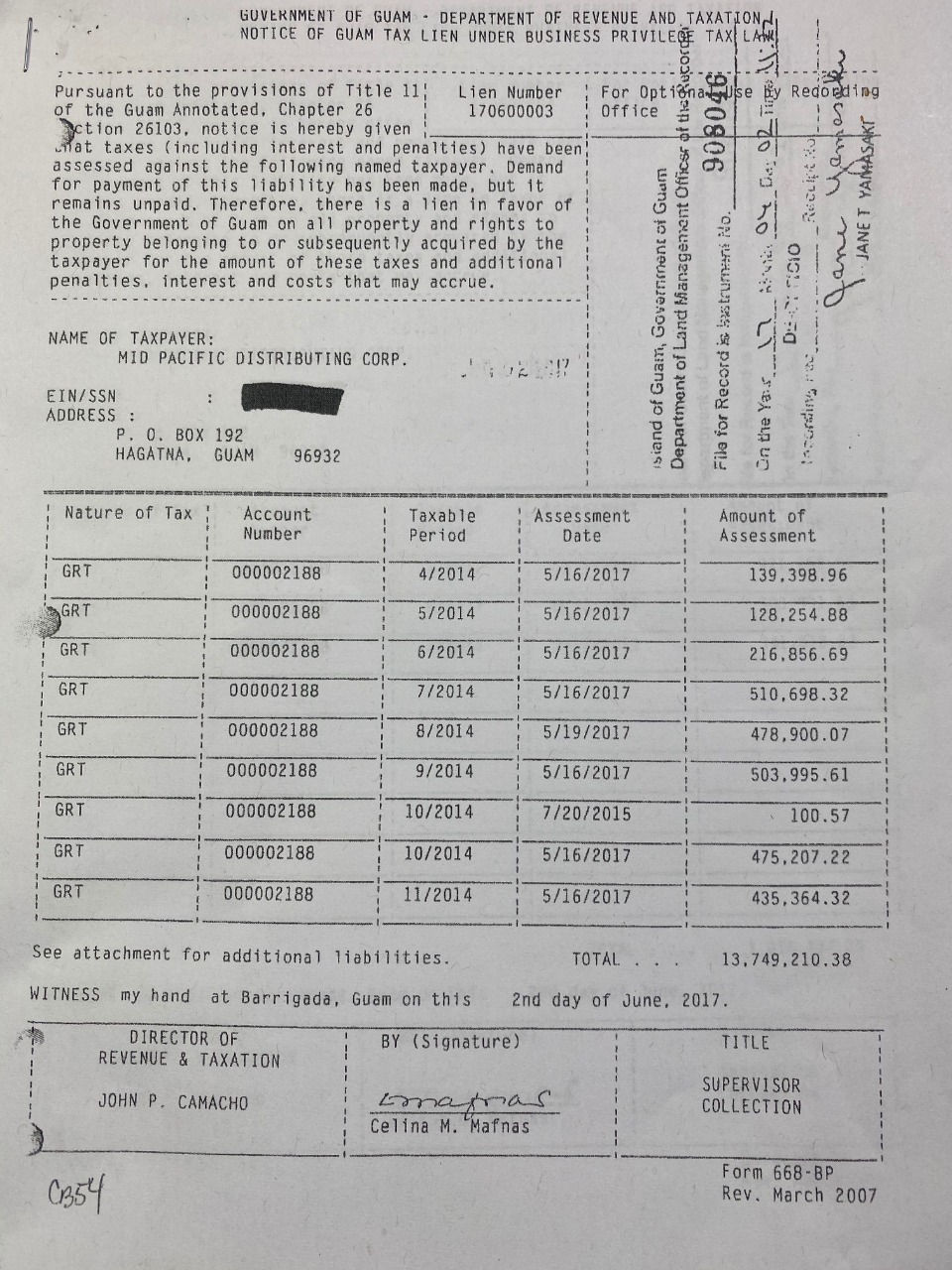

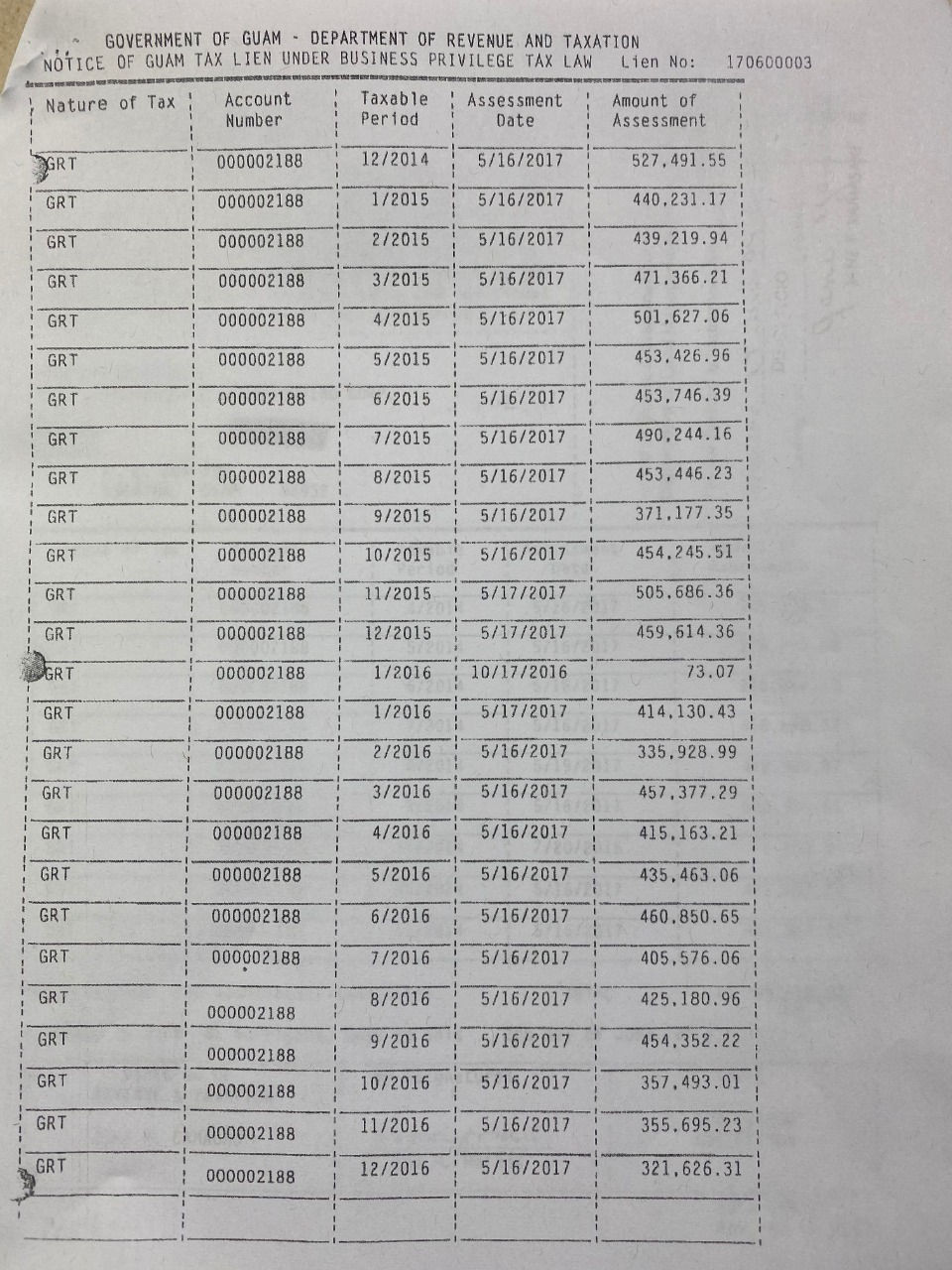

On June 2, 2017, the Department of Revenue and Taxation placed a tax lien on MidPac, a cigarette distribution company owned by the Calvo family. The tax lien revealed that on May 16, 2017, DRT had assessed MidPac for cigarette taxes owed every month from April 2014 through March 2017 - a three-year period. The assessment, totaling $14.7 million, was at a discount of the actual amount of cigarette tax owed to GovGuam for that three-year-period.

Think about that for a minute.

Every time a smoker bought a pack of cigarettes, he and she paid $4 in cigarette taxes that went to the cigarette wholesaler (that the wholesaler was supposed to turn in to GovGuam).

The math shows that the discounted tax liability of $14.7 million means MidPac - at the very least - sold 3.7 million packs of cigarettes, took the $4 per pack sold in taxes and kept that money.

If $14.7 million in tax liability is the discounted amount, imagine how many more packs of cigarettes were sold... upon which the smokers of those packs already paid the $4/pack tax... for which the DRT through the negotiated tax settlement agreement allowed MidPac to just keep that money.

And speaking of this settlement agreement, where is this document? Why haven't the DRT or the OAG disclosed this deal, and how much MidPac was supposed to pay in taxes to begin with?

Was that amount ever verified? Did we just take the Calvos's word for it? I mean, our legal system seems to trust them more than the others who make it to criminal magistrates reports.

On July 27, 2018, Gaynor Daleno in the Guam Daily Post quoted MidPac president John Calvo as saying the allegations of cigarette smuggling (an entire topic on its own that we'll get to) are entirely false. Calvo said that in 2017, "MidPac discovered issues with its reconciliation of tobacco taxes and unilaterally brought the matter to the attention of the Department of Revenue and Taxation. As a result of MidPac's voluntary notice, DRT reviewed the situation, assessed MidPac for additional taxes and then agreed to an installment plan involving substantial initial payments," as well as monthly payments in addition to MidPac's regular ongoing excise tax payments.

Can someone, anyone, tell the public whether those payments are being made on whatever this schedule was supposed to be?

What we don't know since that story was done is whether those taxes have been paid.

What we do know since that story was done is that several of the people involved in the finances and tax collections and settlements of the government of Guam during the Calvo administration ended up working at MidPac and Calvo Enterprises.

The other thing we know? The Office of the Attorney General has never prosecuted anyone for this (discounted) $14.7 million heist.

Comments