By Troy Torres

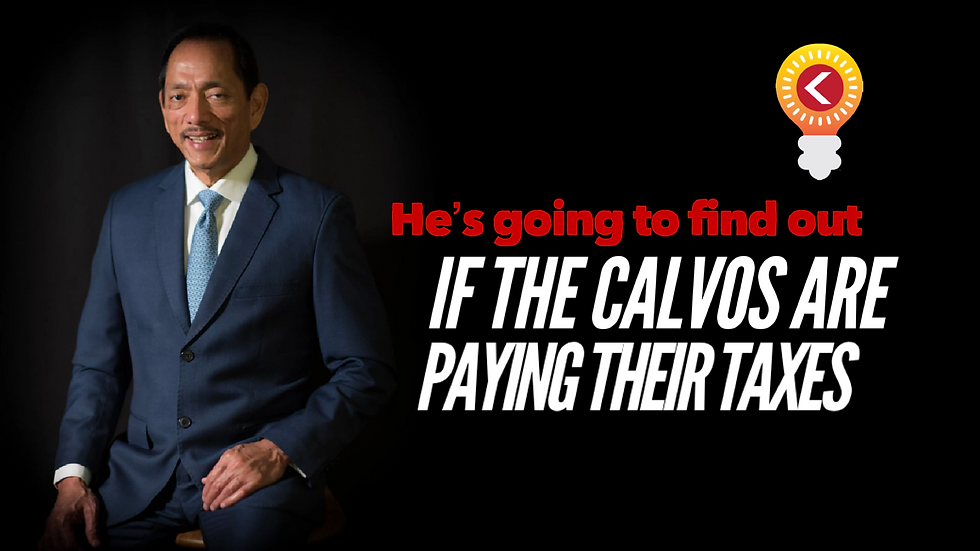

Public Auditor Benjamin J. Cruz, in his audit of alcohol and tobacco taxes, will be asking the Guam Department of Revenue and Taxation for documents that will answer a $14.7 million question:

Did the Calvos ever pay the taxes MidPac owes?

In May 2017, the Calvo administration secretly negotiated a settlement with Calvo-owned MidPac - a cigarette and alcohol distribution company - to pay $14.7 million in cigarette taxes that unconfirmed sources said originally was $90 million in taxes absconded from between 2014 and 2017. No one outside of MidPac and the deep recesses of DRT can actually know what the original amount was, or whether the taxes actually are being paid.

Except for the Office of Public Accountability.

On June 15, Kandit wrote to Mr. Cruz, asking him to use his power, find out whether the Calvos have paid their taxes according to the secret settlement, and let the public know. On June 25, he responded:

"Our office is in receipt of your June 15, 2021 letter requesting for an investigation on the assessment of cigarette taxes. Our office is currently conducting a comprehensive audit on alcohol and tobacco taxes and will include your request in our inquiries with the Department of Revenue and Taxation. Thank you for your request." - June 25 letter from Public Auditor BJ Cruz to Kandit

For Mr. Cruz, this information brings his quest for justice in this matter to full circle. It was Cruz who, when he was speaker of the legislature, wrote to the U.S. Attorney and to the FBI asking them to investigate MidPac for tax evasion and fraud.

"As the Speaker of the 34th Guam Legislature, I am writing to notify the U.S. Attorney’s Office and the Federal Bureau of Investigation of potential violations of federal and Guam law relating to the underreporting and non-payment of cigarette taxes by Mid Pac Distributors (“Mid Pac”), the distributor of Philip Morris branded cigarettes on Guam," Mr. Cruz wrote in his July 26, 2018 letter. "The admitted failure of Mid Pac to report and pay over $14.5 million in local cigarette taxes in the past three years requires federal agencies to investigate the possibility of tax evasion and diversion of cigarette activities—cigarette smuggling—in violation of federal and Guam law spanning beyond the reported three (3) year period."

"How the diversion of cigarettes is being accomplished needs to be investigated by the federal agencies charged with enforcement of federal laws... I hope that by bringing this to the attention of the federal authorities, you are able to assist Guam with enforcement by investigating and stopping further diversion, underreporting, and non-payment of cigarette taxes." - Cruz's July 26, 2018 letter to the U.S. Attorney and the FBI

Two days before that letter, Leevin Camacho’s predecessor, Attorney General Elizabeth Barrett Anderson, wrote to the Department of Revenue and Taxation asking a simple question: How and why did the Calvo administration renew MidPac’s business license during the three years the company owed GovGuam at least $14.7 million in taxes?

In her letter, the former attorney general stated her office would begin an investigation into how it all happened.

Ms. Barrett-Anderson left office months later, when her term ended, and Cruz became the public auditor around the same time. The OAG investigation, as far as the public knows, abandoned her effort.

Recently, a local court declaration by cigarette distributor WSTCO's attorney, Joseph Razzano provides evidence that MidPac and now other distributors did not make timely cigarette tax payments in the first three months of this year. Prior to the declaration, Cruz had already announced his intention to investigate the assessment and collection of cigarette and alcohol taxes, indicating he had been following this issue for some time.

It was June 14, when Kandit sent a Freedom of Information Act request for, among other things, the documents at Guam DRT that will show whether MidPac was paying its taxes according to the secret settlement.

Days later, DRT's Lawrence Terlaje provided the following response:

"DRT is unable to provide you information on your request regarding the abovementioned taxpayer in accordance with Title 11 of the Guam Code Annotated Chapter 26, Inspection of Tax Returns and Information. Stated within §26120, DRT is prohibited from opening to the public tax return or other information filed by Guam taxpayers."

According to the law, DRT can't refuse the same information to Cruz as the public auditor. He is our last hope at transparency in this matter.

Comments